Eggkiki

Guest feature, avian flu, eggs, and shorting Cal-Maine

Hi everyone, happy belated Valentine’s day ❤️

I am super excited to announce that this is my FIRST guest feature Jackiki!!! My wonderful friend Sophia Wang and I co-wrote today’s letter.

Sophia and I met in the Yale Student Investment Group, and we’re currently taking the Yale Endowment class together. The course gives a peek into the world of Swensen’s endowment investing, including speaker events with several of Yale’s investment managers.

A few weeks ago, our professors invited a short investor (quick primer - a short investor bets that a company’s stock price will go down rather than up). Short investors are much rarer than long investors - you have to be contrarian, and have the stomach to make bets when there’s a risk of unlimited losses. I loved learning about the investigative aspect of short investing, especially when it comes to looking for fraudulent companies.

The short investor prepared some simulations to demonstrate the challenges of short investing - one of which was about the cyclicality of eggs prices and chicken hatching.

After class that day, I got this text from Sophia.

Jokes aside, that fantasy portfolio trade led Sophia and I to go on an egg hunt about chicken hatching timelines and how that coincides with stock performance of public egg manufacturers. Call us investigative journalists… or not. But read till the end for our super non-professional investment advice.

THE MAIN KIKI PART 1: WHEN BIRD FLU HITS, CAL-MAINE BENEFITS

Everyone is talking about eggs right now. We’re seeing it in the news (every newsletter/podcast I’m listening to these days has it in the tagline), politics, and most recently on my visit to the grocery store where 12cts were listed at $9.79 and 18cts at $11.69.

Why are egg prices so high? Avian Flu is wreaking havoc on the US egg supply. This disease forces farmers to cull (kill to prevent disease spread) millions of egg-laying hens, shrinking the overall egg supply and driving prices higher. Bird flu has come and gone over the past few decades, with previous notable outbreaks in 2015 and 2022.

But here’s our biggest finding: when avian flu strikes, the largest egg manufacturer in the US (Cal-Maine) benefits.

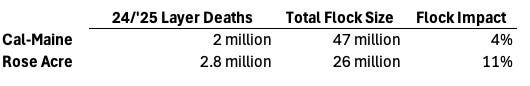

We’ll illustrate this idea by comparing the two largest egg manufacturers: 1) Cal-Maine, and 2) Rose Acre. The 2 main advantages Cal-Maine has over Rose Acre:

Scale

Cal-Maine’s egg-laying chicken population is 2x the size of Rose Acre’s. In 2024/2025, Cal-Maine and Rose Acre culled a comparable amount of egg-layers, but due to Cal-Maine’s larger size, Rose Acre’s flock suffered a disproportionately large impact.

Geography

Cal-Maine’s geographic diversification with 49 facilities across 15 states makes it resilient to regional disease outbreaks. On the other hand, Rose Acre has 17 facilities concentrated in just 7 states, 3 of which already have been heavily exposed to the 2025 avian flu outbreak. This makes Cal-Maine less exposed to bird flu than its competitors.

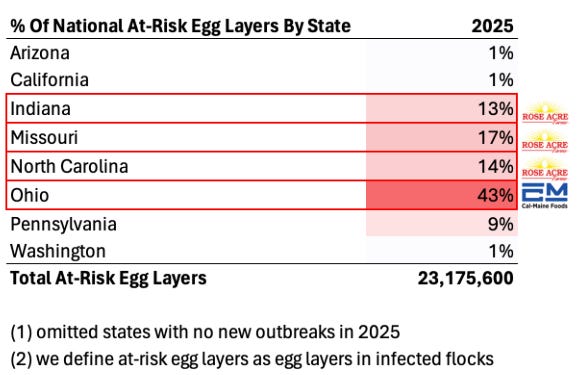

We analyzed 2025 data showing the number of national at-risk egg layers by state, and categorized Indiana, Missouri, North Carolina, and Ohio as ‘problem states’ (each account for more than 10% of the national at-risk egg-layer population). Of these problem states, Cal-Maine only has laying facilities in Ohio, meanwhile Rose Acre has facilities in Indiana, Missouri, and North Carolina. Note: the Ohio % of total national at-risk egg layers statistic looks alarmingly high, but this makes sense given Ohio is the #1 producer of eggs in the US. Cal-Maine has not yet reported outbreaks in its 2 Ohio facilities.

So how does Cal-Maine benefit from the bird flu?

When smaller, less diversified competitors like Rose Acre suffer a major blow from bird flu, the ripple effects work in Cal-Maine’s favor:

Egg-laying hen populations decline, shrinking overall egg supply

Egg prices surge as demand outstrips supply

With a larger, more resilient flock, Cal-Maine takes a smaller inventory hit but sells at these higher prices, boosting profit margins

Increased profitability drives up Cal-Maine’s stock price

Not all egg manufacturers are created equal!

THE MAIN KIKI PART 2: CYCLICALITY CAN HELP US PREDICT RECOVERY…AND MAKE AN INVESTMENT

**In this section, we discuss a Cal-Maine short investment. We want to preface this by saying that this research is purely for fun and NOT professional investment advice!!!**

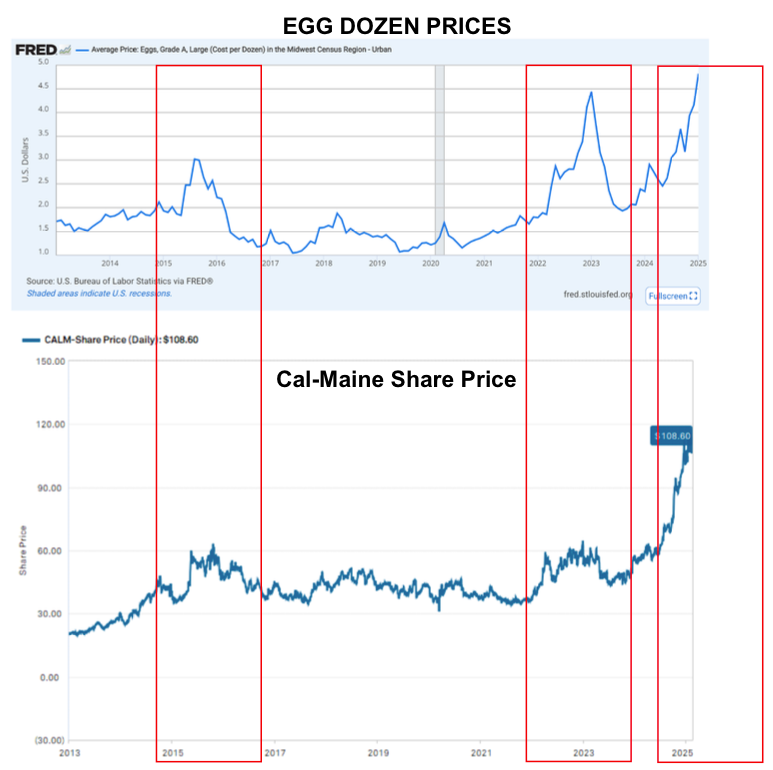

Cal-Maine’s gains are temporary. Egg prices don’t stay high forever. This chart shows the correlation between egg prices and CALM stock in the past 2 major outbreaks (2015 and 2022).

We see a similar trend shaping up in 2025… so the big question when considering a short on Cal-Maine stock is: when will egg prices come down?

Why does it matter for egg prices to fall? Because when prices normalize, Cal-Maine loses its short-term advantage. Right now, CALM is benefiting from elevated prices and a relatively lower hit to its inventory. But once supply rebounds and egg prices drop, its inflated margins will shrink - just as we've seen in past cycles. That creates a shorting opportunity!

The egg market is cyclical. Egg prices typically decrease later in the year because:

Bird flu spread subsides in warmer temperatures.

Feb-July is primary hatching season because warmer weather increases chick survival rates. These chicks become hens and start laying eggs in the summer.

Consumer demand decreases after the winter holidays.

We know prices will come down, but when? The recovery time depends on how long it takes for bird flu to subside and layer supply to rebound.

In this past…

2015: Outbreak began in Dec 2014 → Prices peaked and then fell rapidly in Sept 2015 (9 month lag)

2022: Outbreak began in Feb 2022 with another small outbreak in late 2022 → Prices started falling in Jan 2023 (11 month lag)

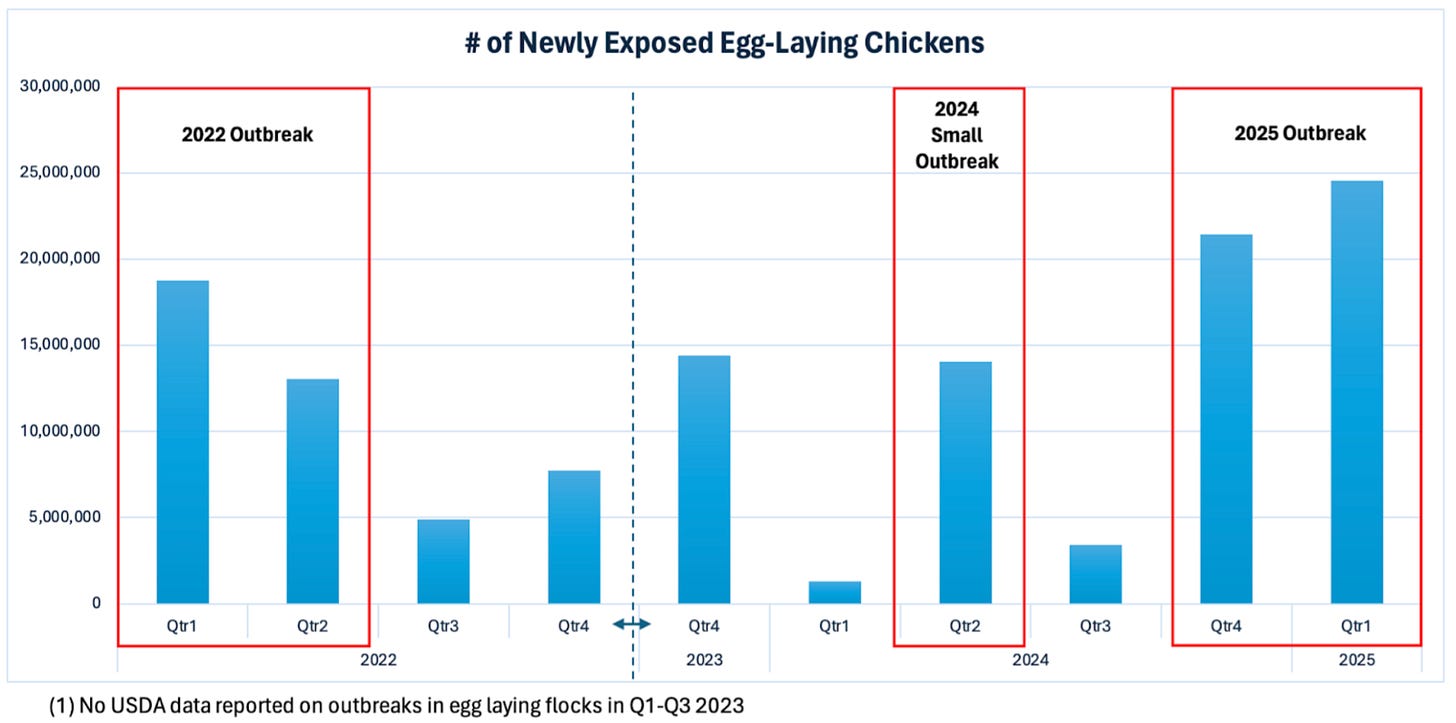

We are not experts and cannot predict exactly when egg prices will decline. Historical outbreak timelines would indicate a recovery sometime in late 2025 or early 2026. However, 2025 appears to be experiencing an especially severe wave of avian flu. The 2025 figures are alarming both in terms of absolute numbers of chickens exposed and proximity to the March 2024 outbreak (chicken supply was not fully recovered from the 2024 hit before taking this new hit).

Given these factors, it is likely that egg prices will take longer to stabilize and Cal-Maine will continue to profit. That’s not great news for shorting Cal-Maine right now (or for our bank accounts)…but prices WILL inevitably come down at some point. Do with that info what you will - but Sophia and I will definitely be placing some Cal-Maine short orders over the next few weeks/months in our fantasy MarketWatch portfolios.

We’d love to hear your ideas/thoughts on this investment idea. Reply to this email or comment below!

That’s Jackiki 12. MEGA THANK YOU to Sophia Wang. More guest features to come!!!

xxx

Sophia & Jackie 🥚

Also, mini milestone: I just passed 500 subscribers!!! I am so grateful for each any every one of you. Writing Jackiki is a joy and I love sharing it with you. THANK YOU!

Don’t count your chickens before they hatch!!

Eggcellent!