Hims & Hers is not going to be so skinny anymore

The end of the Ozempic shortage and a reason to short NYSE:HIMS

Hi everyone, it’s the final stretch of senior year (boohoo). I just came back from an insane spring break where I did a 4-day trek in Peru. I signed up for the trek because I saw the base camp were these sick igloos (see pic below), and didn’t look at the specs of the hike (assumed it would be chill since I am young and active). Nothing could have prepared me for how challenging this hike was. We did 60km in 4 days at 13-15,000 ft of elevation. It was an amazing experience, but def gonna take a few years off the intense hiking to recover.

For today’s main kiki I’m sharing another short pitch (really into thinking about shorting these days). This was a project I did for the Yale Endowment class, but I wanted to wait until it was officially due to share it on Jackiki. The quick summary is in January, I pitched a short for telehealth company Hims & Hers, arguing its overvaluation stemmed from a temporary boost from compounded GLP-1 product sales. I thought as Ozempic shortages resolve, HIMS will lose this crucial revenue stream (legal restriction on compounded drug production), and with a commoditized core business and rising competition, valuation will decline, making for a short opportunity! Funnily enough, this thesis actually materialized on Feb 21, when the FDA announced the end of Ozempic/Wegovy shortages, leading to a 52% decline in HIMS’ stock price at its lowest.

While this is in retrospect, I had a lot of fun with this project (and hypothetically made a 52% gain) – so sharing an edited and shorter version of the pitch below.

THE MAIN KIKI - SHORT HIMS & HERS (NYSE:HIMS)

Company intro

Hims & Hers is a direct-to-consumer (DTC) telehealth platform that provides virtual medical consultations and prescription/over the counter (OTC) medications. They operate across 4 main verticals: sexual health, dermatology, mental health, and weight loss. HIMS’ prescriptions are fulfilled through contracted pharmacies, and the company sells white-labeled OTC products through online and in-store retail partnerships. In 2024, HIMS fulfilled 10.5 million orders across 50 US states and the UK, reached 2.2 million subscribers, and completed ~$1.5 billion in revenue. They are purely cash-pay (no insurance), appealing to higher-income consumers seeking convenience and discretion.

They monetize through:

Subscription model that includes ongoing access to virtual consultations, personalized treatment plans, and medication prescriptions

One-time product sales

Prices range depending on treatment type, from $99 therapy sessions, to $85/month for anxiety prescriptions (Lexapro/Zoloft), to $199/month for GLP-1 treatment.

Recent strategic direction

2 main things here:

Increased personalization: HIMS is shifting from standard virtual consultations to personalized treatments that adjust dosage, format, and address multiple conditions. Offerings now include chewable erectile dysfunction (ED) mints (as opposed to traditional pills), and Sex Rx + Hair Hero combination treatment that targets both ED and hair loss simultaneously. Personalized subscribers now make up over 50% of the base, growing at a 139% CAGR.

Compounded GLP-1/weight loss products: Ozempic is the craze these days, and while this market was originally dominated by legacy players like Eli Lilly and Novo Nordisk, the FDA declared shortages of Wegovy and Ozempic in 2022, which allowed compounding pharmacies to manufacture close approximations of these drugs to fulfill surplus demand. [1] So HIMS moved in in May 2024. [2] The introduction of GLP-1 products proved to be a major growth driver, with the company reporting $225 million in GLP-1 revenue for 2024, and forecasted revenue of $725 million in 2025.

Short investment thesis

TLDR: HIMS is overvalued due to a temporary artificial boost from its compounded GLP-1 offerings. The stock’s surge is unsustainable as the Ozempic shortage will eventually end. Without GLP-1s, HIMS’ core telehealth business remains weak and faces intensifying competition.

Temporary boost from exploiting GLP-1 shortages:

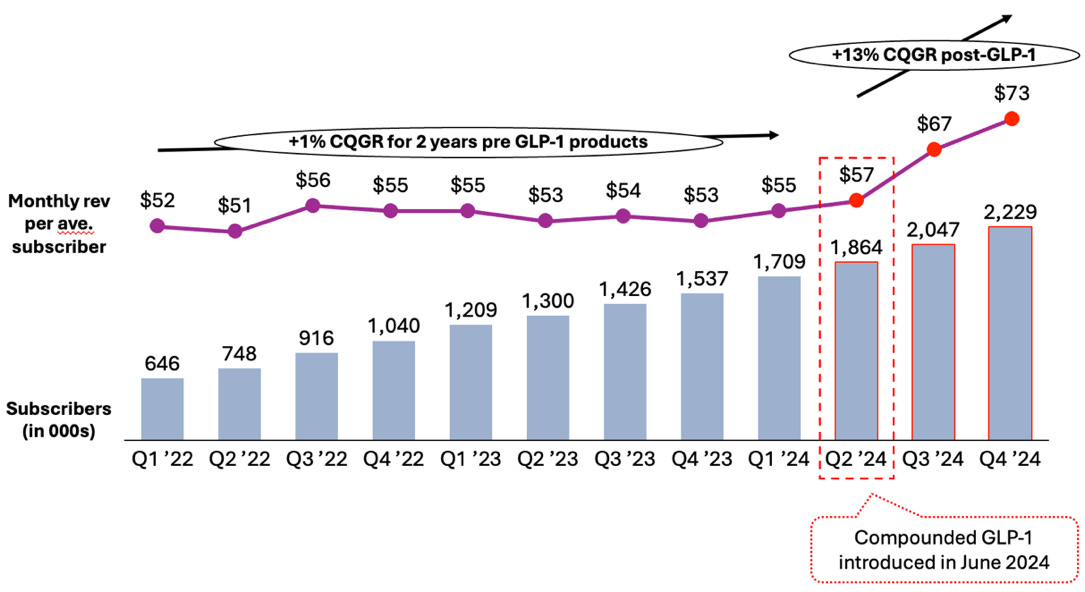

HIMS’ recent financial success, such as turning net income positive and stellar unit economics, appears to be driven by a temporary boost from its GLP-1 offerings. Monthly revenue per subscriber remained flat for two years prior to GLP-1’s introduction but jumped at a 13% compounded quarterly growth rate after its launch (Figure 1). Similarly, AOV skyrocketed from $97 to $137. [3] Both these trends coincide with the significantly higher price point of GLP-1 treatments.

However, this short-term success is artificial, given that compounded GLP-1 drugs are only legally permissible under FDA-declared shortages. I expect this shortage to resolve by end of 2025 latest given they were initially declared in 2022, which means HIMS will no longer be allowed to produce compounded GLP-1s.[4]Management has downplayed the risk, saying the segment only accounted for 15% of revenue in 2024. BUT, this figure is depressed since GLP-1s only became available in the 2nd half of 2024. Annualizing the figure suggests the segment actually contributed 30% of revenue, meaning HIMS could lose nearly one-third of its revenue (!!).

Further, competitors are securing direct partnerships with legacy GLP-1 manufacturers. Teladoc, Ro (HIMS’ closest private competitor) and Life MD have engaged in partnerships with Eli Lilly to offer Zepound vials to customers. [5] [6] HIMS has not indicated plans to have such a partnership, leaving them vulnerable to losing market share in the weight loss segment.

Core telehealth business focuses on either non-FDA-approved products or commoditized FDA-approved products and faces intense competition

HIMS' core telehealth model relies on a mix of non-FDA-approved treatments and commoditized FDA-approved drugs, making it vulnerable to regulatory scrutiny and intense competition. While the company claims its personalized treatments use clinically tested ingredients, this falls short of full FDA approval and weakens credibility. HIMS has also been criticized for downplaying this risk – its 2025 Super Bowl ad (127.7M viewers) failed to disclose that its compounded GLP-1 products lacked FDA approval, and website disclaimers are often buried in footnotes, masked by “clinically proven” messaging. [7]

In its FDA-approved segment, HIMS faces commoditization pressures which limit pricing power. Many of the medications it sells, such as ED treatments and hair loss medications, have well-established OTC alternatives, reducing the value of its telehealth model. The company is also under increasing competitive pressure from both traditional healthcare providers and e-commerce giants transitioning to telehealth including Amazon, CVS, Walgreens, Ro, and Teladoc. The largest threat comes from Amazon whose pairing of virtual with in-person care poses a threat to HIMS’ fully virtual business.

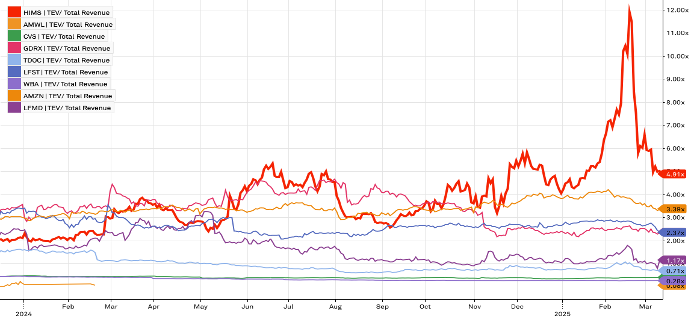

Inflated valuation driven by artificial GLP-1 boost

HIMS’ early 2025 valuation surge has been nearly exponential, reflecting bubble-like behavior. The market appears to be overvaluing the temporary financials spike, despite the likely regulatory end of its GLP-1 segment. HIMS (highlighted in red) trades at significantly higher multiples than peers.

Short Investment Recommendation (in retrospect)

Based on my thesis, HIMS’ fair value should reflect its core business without the temporary boost from compounded GLP-1 sales. A useful proxy is the stock’s pre-GLP-1 announcement price of $14.57 on May 17, 2024 before the GLP-1 announcement on May 20. With the March 14 price at $33.14 [10], the market is likely pricing in either: (1) a doubling of earnings with a stable multiple, (2) a 2x multiple expansion, or (3) a mix of both.

I believe scenario (3) is most accurate. The GLP-1 launch significantly boosted HIMS’ visibility and customer acquisition – many new users, even if not GLP-1 buyers, are now aware of the brand and may convert on other subscriptions. The company has also shifted focus to its oral weight loss segment (now at a $100M run rate) and plans to launch Liraglutide (GLP-1 generic) later this year. While future success is uncertain, these initiatives sustain momentum and support the stock’s premium. Taken together, improved earnings potential and modest multiple expansion suggest the current valuation is close to intrinsic value, hence the short would be 100% covered. Assuming a short position was entered at the peak of $68.74 (Feb 19) and covered at $33.14 (Mar 14), the resulting gain would be ~52%.

Investment Risks

Of course, there are always reasons the stock could go up, e.g. the FDA may reinstate a GLP-1 shortage, HIMS could announce a partnership w Novo/Lilly, or HIMS could get acquired by a competitor. However, these risks are largely speculative, and HIMS’ core business remains ripe for disruption and unlikely to sustain its inflated valuation.

That’s the pitch. Reply to this letter/email/text me if you have thoughts on this – would love to hear them.

THINGS I’M LOVING RIGHT NOW (Peru edition)

Shizen in Lima. Most amazing Japanese Peruvian fusion I’ve had. Jacob and I balled out to reward ourselves after the 4-day hike (got the reservation morning of which was lucky). Matcha-infused gin cocktail, ceviche, udon, and makis that melted like butter.

27 TAPAS in Lima – beautiful sunset bar with live music overlooking the water

Perurail – these trains were sooo luxe, which was a hilarious juxtaposition after coming off day 3 of the hike (my hardest day).

Alpaca burgers - I went to Chakruna burger in Cusco (thanks Alex for rec). Delish.

Non Peru related, but ROLE MODEL. I went to his concert alone last week. He’s my husband surely.

That’s Jackiki 13! See you next time <3

[1] Tin, FDA declares end to Wegovy and Ozempic shortage, 2025

[2] HIMS Investor Relations, Hims & Hers Announces Access to GLP-1 Injections, 2024

[3] HIMS Investor Relations, Investor Presentation, 2025

[4] The FDA announced the end of Wegovy and Ozempic shortages on February 19, 2025

[5] Roy & Roy, Two telehealth firms turn to branded Zepbound as restrictions loom on copies, 2025

[6] Ro Inc., Ro Works with Lilly to streamline patient access to authentic Zepbound vials, 2024

[7] Stoll, Super Bowl TV viewership, 2025

[8] Capital IQ

[9] Yahoo Finance

[10] Stock price on March 14, 2025

Firee