Welcome to Jackiki!!!

new newsletter alert.

If you are reading this, you are officially at the top of my 2024 “in” list (I know its already late February but still). Welcome to Jackiki! As the name suggests, I hope that I can kiki with my readers through this newsletter - I want to share my learnings, what I’m loving, and things that get me excited, amongst other topics. If anything, I’ll have a cool time capsule when I’m 100 (a NYC palm reader told me I’m going to live a long life).

Before I get started on the content of the first letter, I want to mention a bit about the motivation behind starting this newsletter….

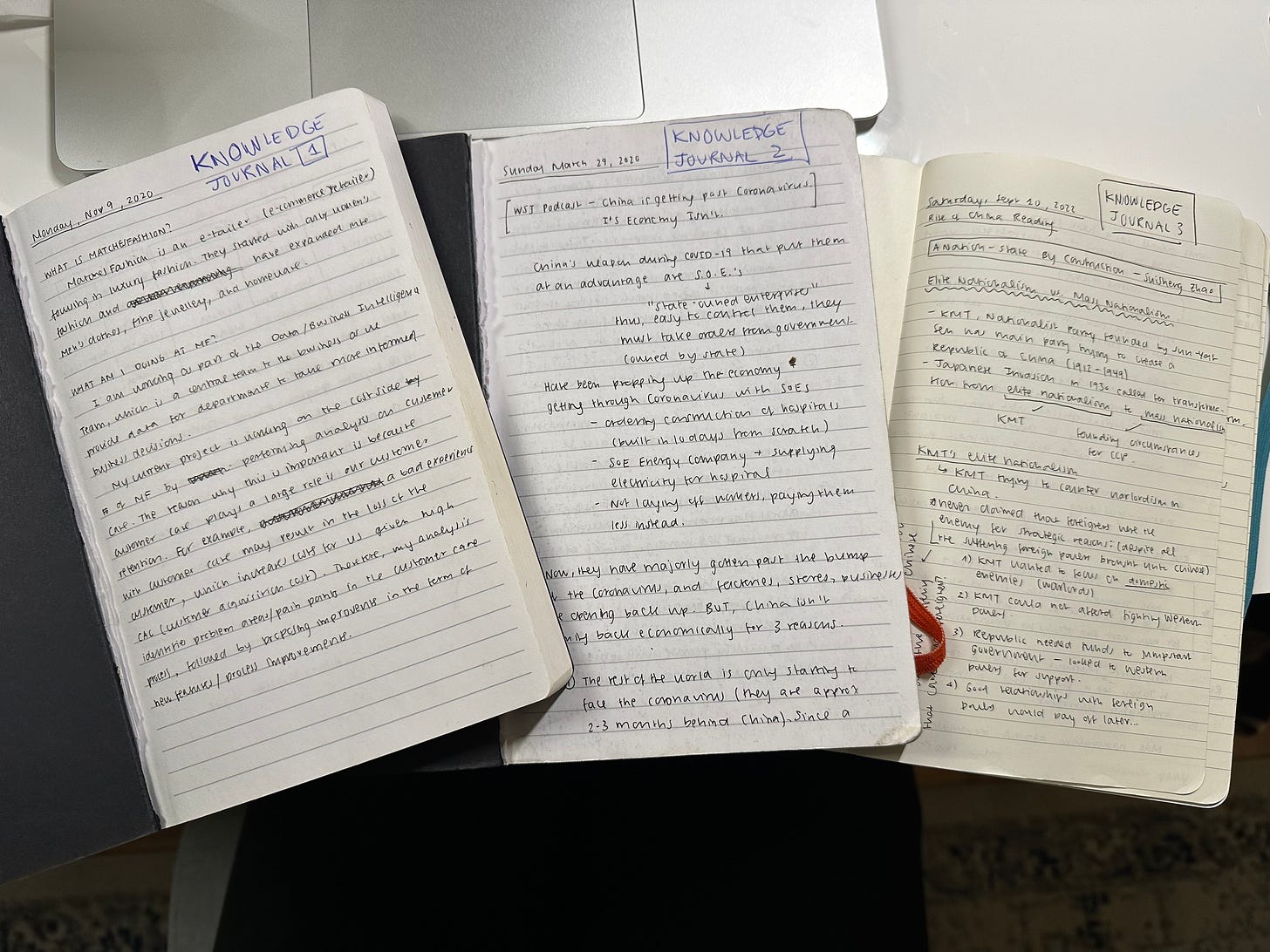

I am a big believer in the compounding power of small educational snippets that add up overtime. One of the promises I made to myself during my pre-college gap year was that I would do things I complained about never having the time to do in high school - mainly diligently keeping up with the news and reading. I started with something small - and committed to listening to a podcast that covered three different business headlines every morning. I listened to it every day, no excuses, and would write down the takeaways and lingering questions in a ‘knowledge journal’ which I also started during my gap year. As my knowledge built upon itself overtime, I felt my world opening.

Funnily enough, 4 years and 3 knowledge journals later, I still listen to the same podcast every morning. I stuck with TBOY though an entire rebranding - they used to be Robinhood sponsored and called “Snacks” and now they spun off and are with Wondery. The two podcast hosts each had a kid (I feel old). And I have introduced TBOY to countless friends who I now bond with over their content. Anyways, all of this to say that I hope this newsletter can do something similar in terms of what TBOY did for me. All the small tidbits of knowledge accumulated over time have earned me a seat in discussions which have only further contributed to a positive knowledge flywheel. Also, I am a junior at Yale and realizing I only have three semesters left in college and want to capture some of the inspiring conversations and learnings.

Here’s a pic of my knowledge journals. I love them dearly and still read through them from time to time.

OK…LET’S START!

SNIPPETS

Jenny Fleiss, one of the co-founders of Rent The Runway, came to Yale for a talk in collaboration with Tsai City. RTR was founded in 2009 during a recession - my first impression was: why would anyone start a business in a recession? It seems like not a great time to put all your savings into starting your next new business venture. Consumers are not spending because of economic volatility, there is limited access to capital as lenders are more cautious about giving loans to new business owners, and general economic outlook is murky. Jenny Fleiss changed my mind pretty quickly - she said that recessions are when inefficiencies of supposedly healthy companies become unveiled, which creates opportunities for new businesses to enter the market. Yes, it’s risky to start a company during a recession, but it is when there is a need for new companies and innovations, and when inspiration strikes, you have to run with it! Fun fact: nearly half of the Fortune 500 companies were founded during economic recessions. Uber was founded in 2008, and its initial viability can be attributed to the recessionary environment where unemployment was high, creating a pool of available workers to become drivers for the platform. Airbnb’s initial value prop capitalized on the recession as well, where consumers who had lower purchasing power were unable to afford expensive hotels. As a result, Airbnb tapped into the sharing economy to offer lodging at lower prices. The takeaway is that recessions expose gaps in the market, and hence why many new innovations are born to meet these novel needs.

Adults make mistakes… big ones… that move markets. Ok, move markets is an exaggeration, but Lyft had a typo in their recent earnings call where they accidentally added an extra 0 to their adjusted EBITDA margin expansion, reporting a 500 bps (5%) increase, instead of 50 bps (0.5%) increase. The stock popped by 35% and then fell again. This made me curious to look at other earnings calls slip ups/funny moments. This video is funny but also crazy - it includes some of the wildest comments made during earnings calls including from Elon Musk (Tesla) and Jeff Skilling (Enron).

My fave TBOY story this week was about Vail Resorts’ strong hold on American mountains. Vail owns 42 resorts in North America, Australia, and Europe with their most popular resorts including Park City, Heavenly, NorthStar, and Beaver Creek. The company was taken out of bankruptcy by Apollo in 1992, went public in 1997, and is most well known for its Epic Ski Pass. There are 3 beautiful things about the Epic Ski Pass:

It has a strategic pricing plan: Vail has upped the day pass prices so much that consumers are incentivized to invest in the Epic season pass instead. The strategy has worked to say the least - in 2016, Vail sold 650,000 Epic passes, which then doubled to 1.2 million in 2019, and then doubled again to 2.4 million in 2023!!! I used to think subscriptions only pertained to digital products, but Vail is making in-person leisure into a subscription. Pretty genius. At the end of the day, consumers love a good-value deal.

It turns a negative working capital business into a positive working capital business. Since the Epic Pass is an upfront payment for the rest of the season, Vail is able to collect this cash upfront and use it to pay off expenses throughout the year rather than the alternative of paying expenses before getting money from ski passes.

It insulates the business from bad snow years. Vail restricts Epic Pass sales after a certain date every year. This means that people buy the Epic Pass without knowing what the mountain conditions for that year will be. This locks skiers into paying Vail regardless of the snow season.

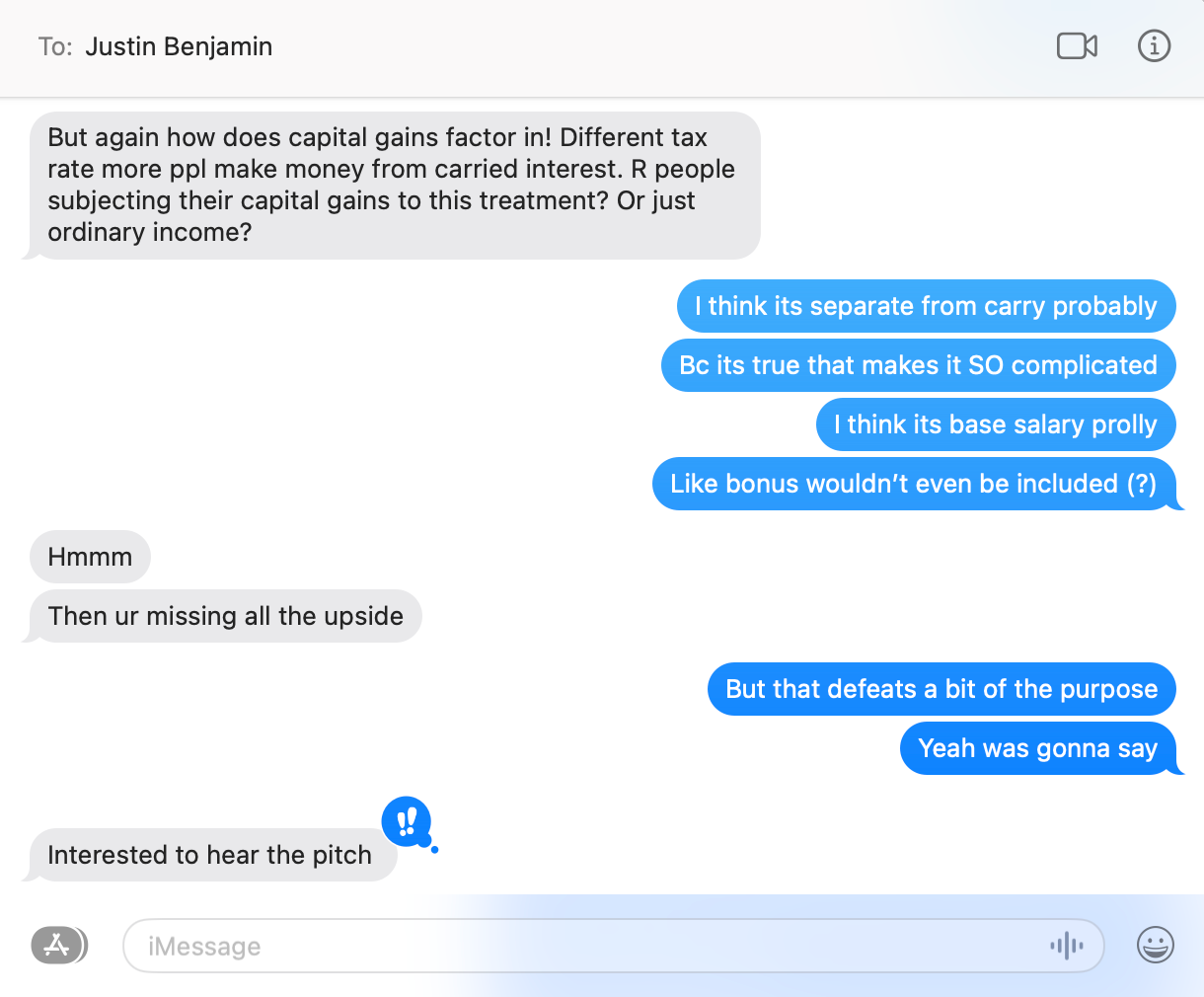

A Yale startup called Prospinity pitched to one my of extracurriculars this week. The TLDR is the product centers around “success pooling” - a group of people can come together and commit income over a certain threshold to a communal success pool over a chosen time horizon. Every year, the pool gets divided equally amongst everyone who contributed. Interesting idea, right? I had many questions post hearing the pitch, mainly around incentives. The founders explained that the value prop of success pooling is diversifying your income - for example a consultant can pool with an artist and reap the benefits of when the other ‘hits it big’. My immediate reaction is, what if the artist takes a long time to ‘hit it big’, the consultant would essentially be subsidizing the artist for that entire time, and the incentives become unbalanced. What I’m getting at is an adverse selection problem - where people who make less income will naturally self-select into a success pool in hopes to pool with someone making a higher income, and vice versa, high-earners will refrain from pooling with low-earners. I was chatting with my friend Justin about other questions including how tax treatments on the success pool work. Since income is being distributed to someone other than the original earner, there would technically be a gift tax applied to the success pool distributions. So essentially this income would be double taxed from income tax and then gift tax, at which point the amount dwindles to a fraction of the original earning. Isn’t there a better way to spend these funds? Questions questions questions… including this last one about capital gains and carried interest below. Carried interest, or “carry” for short, is the percentage of a PE fund's investment profits that a fund manager receives as compensation. Carry is one of the primary ways fund managers are paid in private equity (and also venture capital).

I am taking a private equity class with a bad ass female professor (ex private equity powerhouse) which has got me even more interested in the sector. Something I learned is that in a tough fundraising market, PE funds are exploring a new fundraising model in hopes to attract more investors. Just to break down some basics on how PE firms traditionally work: a PE firm will reach out to investors (aka “LP’s”) and ask them to commit a certain amount of money to a capital pool. Usually, these commitments are not paid up front, but rather “capital-called” over time as the PE firm makes new investments and adds more companies to their portfolio. What this means in practice is that investors are locking up capital for 10 years (or whatever the duration of the fund is), and must pay the PE firm whenever they get capital-called. However, in a high-interest rate environment, it is not as attractive for investors to lock up capital in a PE fund for several reasons:

There is an opportunity cost - investors could consider bonds or savings accounts that offer returns with lower risk compared to PE (and are also more liquid)

There is a higher cost of borrowing which can significantly reduce returns given that PE firms use leverage to finance acquisitions

Firms might push investors to lock up their capital for even longer than the original fund duration because of limited exit opportunities in high rate environments. The extra lock up only increases opportunity costs.

In light of this, instead of asking for 10-year capital lock ups, PE firms are now fundraising on a deal-by-deal basis. This allows investors to have more flexibility and lower management fees (PE firms make money by taking a cut of committed capital - called the “management fee”). I am curious to keep following this and to see if this model sticks in a low-rate environment. If it does, it would introduce more complexities for PE firms, who would have to fund raise more frequently in between each potential deal. Perhaps this would slow the pace of deals in the PE world? Not sure, just some initial ideas…

THINGS I’M LOVING RIGHT NOW

Using the stickies app on my desktop - it clutters a bit, but it’s also so in your face that I’ve found it to be the most effective way to keep track of my day to day to-dos and reminders.

Clarins invisible solar stick Roll on sunscreen - honestly, this product is amazing (shout out mom for putting this on my radar!!). The ease of use is incredible, you just twist it and glide it over your skin. I think part of what dissuades me from putting on sunscreen is the oily feel left on my fingers after applying. It was a complicating factor to add an extra step of washing my hands after sunscreen which made me drop the entire routine. But this stick has helped me get back to consistently putting sunscreen on. I love products like these that prioritize ease of use - I feel it is one of the ways to win in consumer. Link to buy here.

Elinor Hoover, Chairman of Global consumer/retail investment banking at Citi, came to Yale for a women’s leadership conference. The talk was about being a woman in a male dominated industry, and she emphasized the importance of building your confidence. She made an analogy of confidence as four legs of a table that really resonated with me. When one leg is not as strong you rely on the other legs to stabilize yourself, and as you find stability, you can begin to build strength in that weaker leg to eventually stand strong on all four (or rather my two) feet.

My friends and I got lunch with

from Feed Me (my fave newsletter) in NYC!!! This was undoubtedly the highlight of my week - we kiki’d for two hours over some fire tacos at Empellon and talked about Emily’s day-to-day as a writer, celebrity brands, Gen Z vs millennials vs Gen Alpha, and Yale’s secret societies, amongst other stuff. Never doubt the power of the cold email (shout out Arden)!!!

Ok love you bye!!! Let me know your thoughts in the comments and topics you find interesting that I can cover in the future (or I think you can reply to this newsletter from your mail app and it will automatically email me). The next letter will include an interview with Sara Levinson, the ex President of NFL Properties.

Let’s Jackiki again soon. I am planning on sending a letter every two weeks. xx

Amazing! I love the RTR and Vail breakdown.. can’t wait for the NFL breakdown

Found you via Emily's rec and loved this read! The Vail business model is sort of horrific for consumers but genius for them. I'm curious to see when/how ski resort conglomerates get regulated or capped. The rate of price increases over the last 10 years is mind boggling and has made skiing pretty inaccessible.